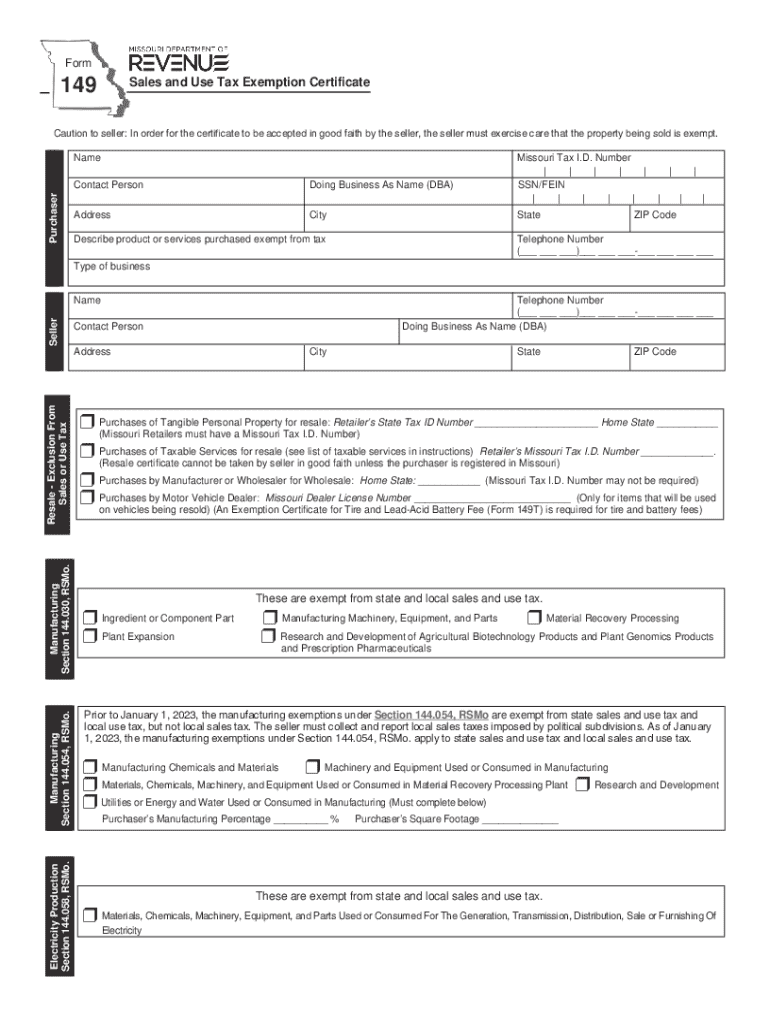

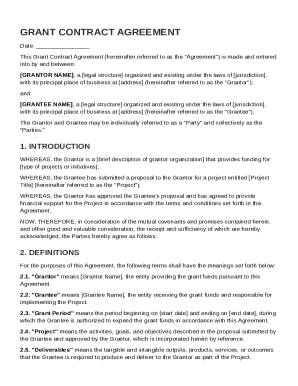

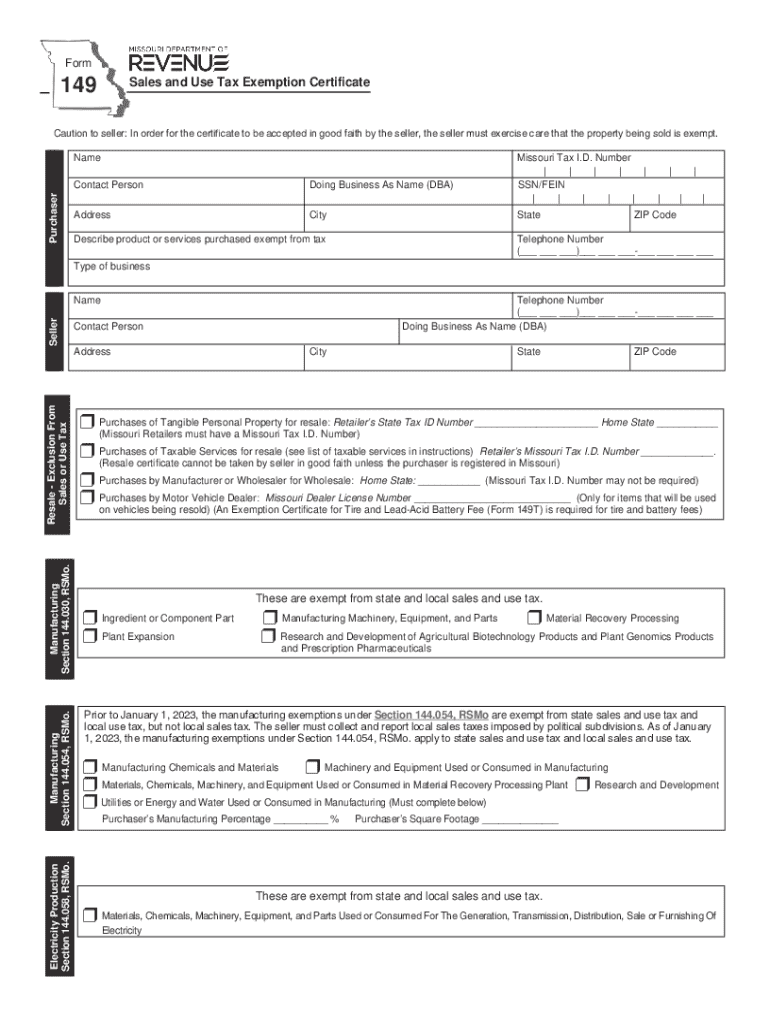

MO DoR 149 2025-2026 free printable template

Get, Create, Make and Sign MO DoR 149

Editing MO DoR 149 online

Uncompromising security for your PDF editing and eSignature needs

MO DoR 149 Form Versions

How to fill out MO DoR 149

How to fill out 149 - sales and

Who needs 149 - sales and?

149 - Sales and Form: A Comprehensive Guide to Effective Business Transactions

Understanding sales forms

Sales forms are essential documents used in business transactions, serving as formal agreements between buyers and sellers. They encapsulate the details of a transaction and establish a transparent record that both parties can rely on. The importance of sales forms cannot be overstated; they help mitigate misunderstandings, ensure accurate record-keeping, and facilitate smoother financial operations.

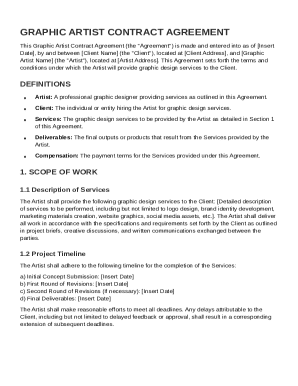

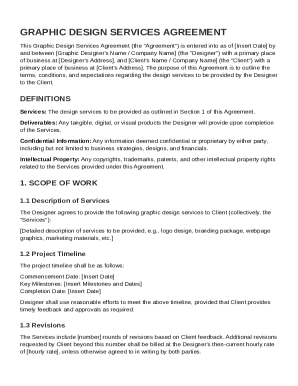

There are several types of sales forms commonly utilized, including invoice templates, purchase orders, and sales agreements. Each type serves a different purpose but ultimately aims to clarify the terms of a transaction. For instance, an invoice template is essential for requesting payment post-transaction, while a purchase order details the items being bought and serves as a buyer's official request to the seller.

Overall, sales forms play a pivotal role in ensuring that all transactional details are clearly documented, providing protection and clarity for both parties involved.

Key features of effective sales forms

Effective sales forms include several essential elements. First and foremost, they must have a clear title and identification features, making it easy for both parties to reference the document in future communications. Including comprehensive buyer and seller information is also critical; this should capture the name, contact details, and relevant company information.

An itemized listing of products or services is another key feature. This section should detail each item or service, quantity, unit price, and total cost to avoid discrepancies. Furthermore, the layout and design of sales forms should prioritize usability. A well-structured form offers clear sections, guides the user logically through the necessary information, and employs a clean design for easier comprehension.

In summary, clarity and simplicity are paramount in designing user-friendly sales forms, enhancing their effectiveness in facilitating transactions.

Creating a sales form with pdfFiller

Creating a sales form using pdfFiller is both intuitive and efficient. To start, you’ll want to select the appropriate template from the extensive library that pdfFiller offers. Consider the specific needs of your business and the type of transaction you are conducting to choose the most suitable template.

After selecting the template, customization begins. This is where you can add your company logo and establish branding that aligns with your corporate identity. Additionally, don’t forget to fill in the buyer and seller's information, which is crucial for the document's validity.

The next step involves editing fields to enhance the presentation using pdfFiller’s user-friendly tools. You can utilize text boxes and checkboxes to make information input seamless. This customization ensures that your sales form not only provides necessary information but also looks professional and inviting.

Signing and managing sales forms

Once your sales form is created, signing it is the next critical step. pdfFiller makes this process straightforward with its eSigning capabilities. Adding legal signatures can be completed in just a few clicks, with options for multiple signers if necessary. Leveraging eSigning not only provides a legally binding signature but also accelerates the sales process, allowing for quicker acceptance of terms.

Consequently, sharing and distributing your sales form is incredibly easy. With pdfFiller, you can send forms directly via email or share them through a link. However, it’s crucial to consider any limitations, such as potential file size restrictions when distributing forms. Furthermore, tracking responses is a valuable feature that aids in managing follow-ups and refining your sales strategy. Utilizing pdfFiller's analytical tools provides insights into how engaged your clients are with the forms you send.

Advanced tips for sales forms management

To enhance the efficiency of your sales operations, consider integrating sales forms with your CRM systems. This integration not only reduces administrative workload but also improves customer relationship management by keeping all client interactions readily accessible. Having this data linked ensures you maintain accurate records and can provide tailored communications.

Additionally, automating recurring sales forms can streamline your processes significantly. Setting up templates for regular use allows your team to save time on repetitive tasks. Automation mitigates human error risks and ensures that your sales documentation remains consistent and professional across all client interactions.

Common mistakes to avoid with sales forms

One of the most prevalent mistakes businesses make with sales forms is underestimating the importance of accuracy. Errors in figures or customer details can lead to disputes and tarnish relationships. It's vital to encourage diligence in completing these forms to ensure all information is correct and complete.

Additionally, many organizations fail to adapt their forms for different markets or customer segments. Customizing sales forms to better meet the needs and expectations of specific audiences can vastly improve engagement and satisfaction. Another common pitfall is the failure to update sales forms regularly. Keeping your forms reflective of changes in pricing, services, or legal requirements is essential to maintaining credibility.

Conclusion of key takeaways

In conclusion, a well-crafted sales form is fundamental to successful business transactions. The accuracy and clarity of the document reflect on your professionalism and can significantly affect customer satisfaction. By leveraging tools like pdfFiller, businesses can streamline the creation, management, and signing of sales forms, aiding in efficiency and error reduction.

Embracing these strategies and utilizing the features offered by pdfFiller will not only enhance your sales form management but also empower your team to operate more effectively in a competitive marketplace.

People Also Ask about

How do I become tax exempt in NY?

How much is a seller's permit in Louisiana?

How do I get a US sales tax exemption certificate?

What is Missouri form 149 for?

What is the tax exempt form for NYC?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MO DoR 149 online?

How do I make edits in MO DoR 149 without leaving Chrome?

How do I fill out MO DoR 149 using my mobile device?

What is 149 - sales and?

Who is required to file 149 - sales and?

How to fill out 149 - sales and?

What is the purpose of 149 - sales and?

What information must be reported on 149 - sales and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.