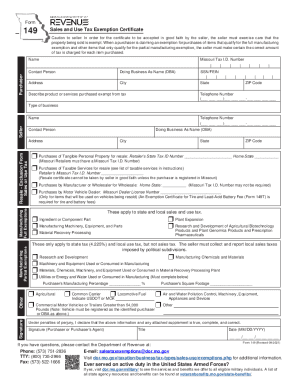

MO DoR 149 2022-2024 free printable template

Get, Create, Make and Sign

Editing missouri tax exempt form 149 online

MO DoR 149 Form Versions

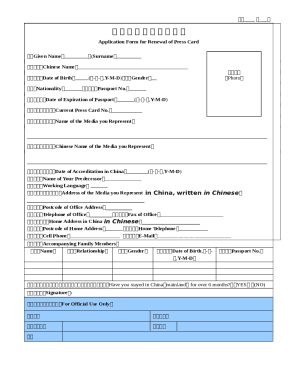

How to fill out missouri tax exempt form

How to fill out form 149 sales tax?

Who needs form 149 sales tax?

Video instructions and help with filling out and completing missouri tax exempt form 149

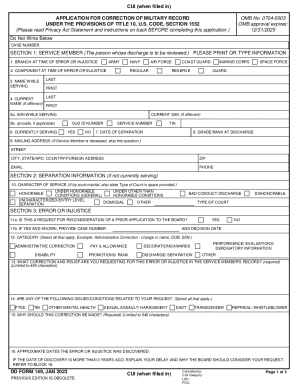

Instructions and Help about missouri tax exempt form

Hello everyone does you have a problem that just can't be solved have you exhausted all avenues and just can't find a way to fix your problem well I have a way that you just might be able to fix it anyway stand by hello everyone it's DJ have you got a problem that you just can't fix you've tried everything in the world, and you just can't seem to resolve your problem well there is a way that you might be able to fix it, and I'm going to teach you how to do so today so let's say that you have a problem with your records which is preventing you from qualifying for a benefit which you have earned let's say you have a problem with your records which okay I will do that if you've seen the police squad TV show or The Naked Gun movie series then you know that joke, but I won't go into was so let's move on anyway so what happened or didn't happen ardor what has happened or what didn't happen and your records show something that you are not eligible for be it something retirement related retirement eligibility or a pay grade you should have or just about anything else let's say you've got a problem, and you just can't fix it you've exhausted all other avenues to correct problem and nothing's working you might have even filed a congressional complaint as much as I said for or against those in the past in fact I would say look at my video on whether you should file a congressional inquiry I'll put a link-up here so you can see that if you still have a problem even after that much vaunted congressional inquiry in fact most of the time at least from what I've seen those don't work what can you do well there is something out there available to you when all other attempts have failed they're in one last thing you can try federal law direct each branch of the military even the Coast Guard even though we sometimes called the baby Navy about where the puddle pirates under my blinds just fell apart oh well anyway so even the Coast Guard they all have what's called a Board of Corrections for military records or BPM are specifically the law says, and I'll read it here the Secretary of a military department may correct any military record when the secretary considers it necessary to correct an error or remove and injustice, and then I have a link to the specific section of law that says that you can find that in the notes for this particular episode but did you notice the key statement there the law allows the branch of service to correct not only a problem with a record but an injustice as a result of that problem for example let's refer back to an episode that I had back in June of last year about the fender project fat tin jerk to properly enunciate where I talked about a widow who was not receiving certain benefits in that story I told you about a widow whose husband had not applied for his retirement due to a debilitating illness as a result he never received his military retirement neither of them had TRI CARE coverage and when he passed away the widow did not...

Fill mo tax exempt form : Try Risk Free

People Also Ask about missouri tax exempt form 149

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your missouri tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.